In an increasingly intricate global environment, finance operates as a framework for interpreting value, risk, and consequence. It is not merely the management of money, nor is it confined to balance sheets and ledgers. Finance is a system of thought—one that governs how resources are mobilized, preserved, and transformed over time. Some decisions are immediate. Others unfold slowly. Both are bound together by the logic of finance.

At its most refined level, finance reconciles aspiration with constraint. It disciplines ambition without extinguishing it. Capital is finite. Time is irreversible. Uncertainty is pervasive. Within these boundaries, finance provides structure, enabling individuals and institutions to act with coherence rather than impulse.

The Structural Anatomy of Finance

The anatomy of finance is composed of allocation, valuation, and stewardship. Allocation determines where resources flow. Valuation interprets future potential through present metrics. Stewardship ensures continuity across cycles of growth and contraction.

Capital allocation is rarely neutral. Every deployment reflects priorities, beliefs, and assumptions about the future. Finance interrogates these assumptions, subjecting them to modeling, comparative analysis, and probabilistic reasoning. What appears attractive in isolation may prove fragile in context.

Valuation within finance extends beyond price discovery. It incorporates optionality, time preference, and asymmetric payoff structures. A delayed return may justify a present sacrifice. Conversely, immediate gains may conceal long-term erosion. Discounting methodologies exist to clarify these trade-offs, but judgment remains indispensable.

Stewardship completes the structure. Finance demands accountability—not only to shareholders or stakeholders, but to the continuity of the system itself. Liquidity management, capital buffers, and governance mechanisms preserve optionality when conditions deteriorate.

Finance and the Nature of Risk

Risk is not incidental to finance. It is foundational. Volatility, default, inflation, and systemic disruption constitute the environment in which finance operates. The objective is not risk elimination, which is illusory, but intelligent calibration.

Advanced finance differentiates between risks that are rewarded and those that are merely endured. Hedging instruments, diversification strategies, and structural protections exist to mitigate exposure, yet their efficacy depends on clarity of intent. Complexity without comprehension magnifies fragility.

Short-term risk is often dramatic. Long-term risk is often invisible. Excessive leverage, deteriorating liquidity, and misaligned incentives accumulate quietly. Sound finance recognizes these slow-moving threats and addresses them before they metastasize into crisis.

The Behavioral Undercurrents of Finance

Despite its analytical veneer, finance remains deeply influenced by human behavior. Emotion distorts perception. Narratives override data. Confidence expands during prosperity and evaporates under stress. These dynamics shape outcomes as decisively as any model.

Behavioral insights have therefore become integral to modern finance. Decision frameworks are designed to counter bias. Incentives are structured to align long-term outcomes with short-term actions. Process becomes a safeguard against excess.

Patience is undervalued. Yet in finance, patience compounds. Restraint preserves capital. Discipline creates endurance. Markets may reward speed in the moment, but longevity favors those who resist reflexive action.

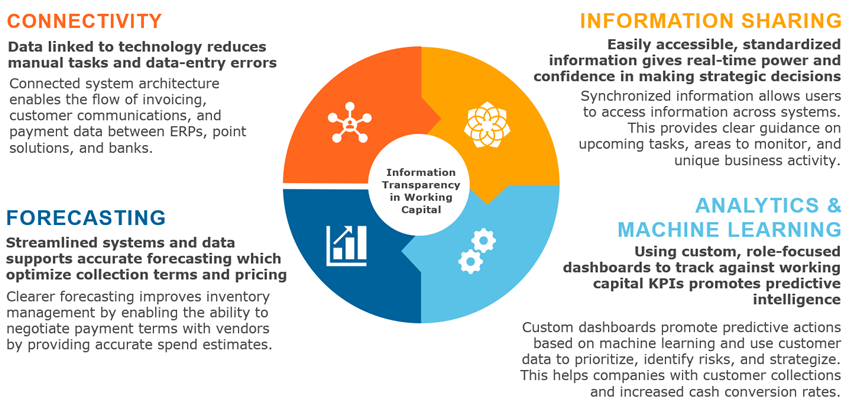

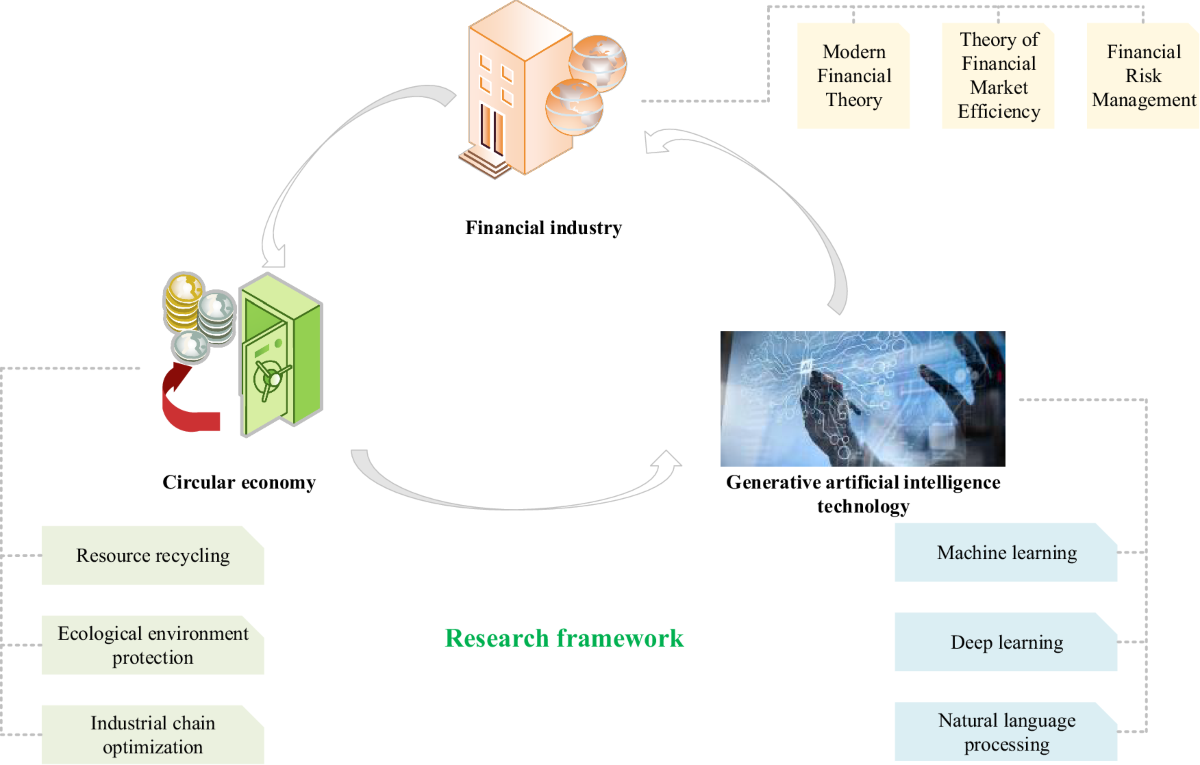

The Expanding Domain of Finance

The domain of finance has expanded to absorb technological acceleration, regulatory density, and geopolitical interdependence. Digital systems compress transaction timelines and amplify connectivity, while simultaneously increasing systemic sensitivity.

Regulatory frameworks add complexity but also signal collective priorities. Effective finance interprets regulation as a design parameter rather than an obstacle. Transparency becomes an asset. Compliance reinforces credibility.

Global interconnectedness further intensifies the stakes. Interest rate shifts, currency fluctuations, and capital mobility transmit localized decisions into global repercussions. In this environment, finance functions as a navigational discipline—constantly recalibrating position amid shifting reference points.

Strategic Finance and Institutional Resilience

Strategic finance privileges resilience over spectacle. It emphasizes liquidity, adaptability, and downside protection. Growth pursued without structural integrity is ephemeral. Profit extracted without sustainability is corrosive.

Metrics within strategic finance therefore extend beyond surface performance. Cash flow durability, balance sheet flexibility, and stress-test outcomes reveal systemic health. These indicators matter most when conditions deteriorate.

Long-term orientation distinguishes excellence in finance. Decisions are evaluated not only for immediate effect, but for cumulative impact across cycles. This perspective transforms finance from a reactive function into a stabilizing force.

The Enduring Relevance of Finance

Ultimately, finance is the discipline through which intention becomes executable. It aligns resources with purpose, risk with reward, and present action with future consequence. Tools evolve. Terminology shifts. Contexts change.

Yet the essence of finance endures. It remains the quiet architecture beneath economic activity, shaping outcomes long before they are visible. In a world defined by uncertainty, finance provides not certainty, but coherence—and that distinction is decisive.