The Foundational Scope of Finance

Finance is the structural framework through which value is measured, preserved, and multiplied. It governs how resources are allocated across time, balancing immediate necessity against future aspiration. At both institutional and individual levels, finance functions as a decision-making discipline grounded in analysis, foresight, and calculated risk.

Beyond numbers and ledgers, finance represents an intellectual system. It integrates mathematics, behavioral insight, macroeconomic signals, and strategic judgment. In an increasingly volatile global environment, mastery of finance determines not only profitability, but endurance.

Capital Allocation and Strategic Intent

At the heart of finance lies capital allocation. Every allocation choice implies opportunity cost. Funds committed to one initiative are simultaneously withheld from another. Effective finance evaluates these trade-offs with rigor, prioritizing initiatives that align with long-term objectives while maintaining operational liquidity.

Capital efficiency distinguishes resilient organizations from fragile ones. Excess capital breeds complacency. Scarcity breeds discipline. Finance imposes structure on ambition, ensuring that growth is funded sustainably rather than impulsively. This discipline transforms capital from a static asset into a strategic instrument.

Risk, Uncertainty, and Financial Judgment

Risk is inseparable from finance. Markets fluctuate. Assumptions decay. External shocks disrupt forecasts. The objective of finance is not risk elimination, but risk calibration. Intelligent exposure replaces blind speculation.

Quantitative models provide guidance, yet judgment remains indispensable. Historical data illuminates patterns, not certainties. Finance therefore combines statistical inference with prudential restraint, acknowledging uncertainty while preparing for volatility. This duality defines sophisticated financial stewardship.

Liquidity, Solvency, and Financial Stability

Liquidity is the lifeblood of any financial system. Solvency is its spine. Finance manages both simultaneously, ensuring that obligations can be met without compromising long-term viability. Imbalances between liquidity and leverage often precede systemic failure.

Short-term cash flow mismanagement can undermine otherwise sound enterprises. Conversely, excessive conservatism can stifle innovation. Finance navigates this tension through structured forecasting, stress testing, and contingency planning. Stability emerges from balance, not excess.

The Behavioral Dimension of Finance

Human behavior exerts a profound influence on finance. Emotion, bias, and perception often distort rational analysis. Fear amplifies downturns. Euphoria inflates bubbles. Behavioral finance examines these psychological undercurrents, revealing why markets deviate from theoretical efficiency.

Awareness of behavioral distortions enhances decision quality. It tempers overconfidence. It encourages contrarian evaluation. In this context, finance becomes as much a study of human nature as of numerical precision.

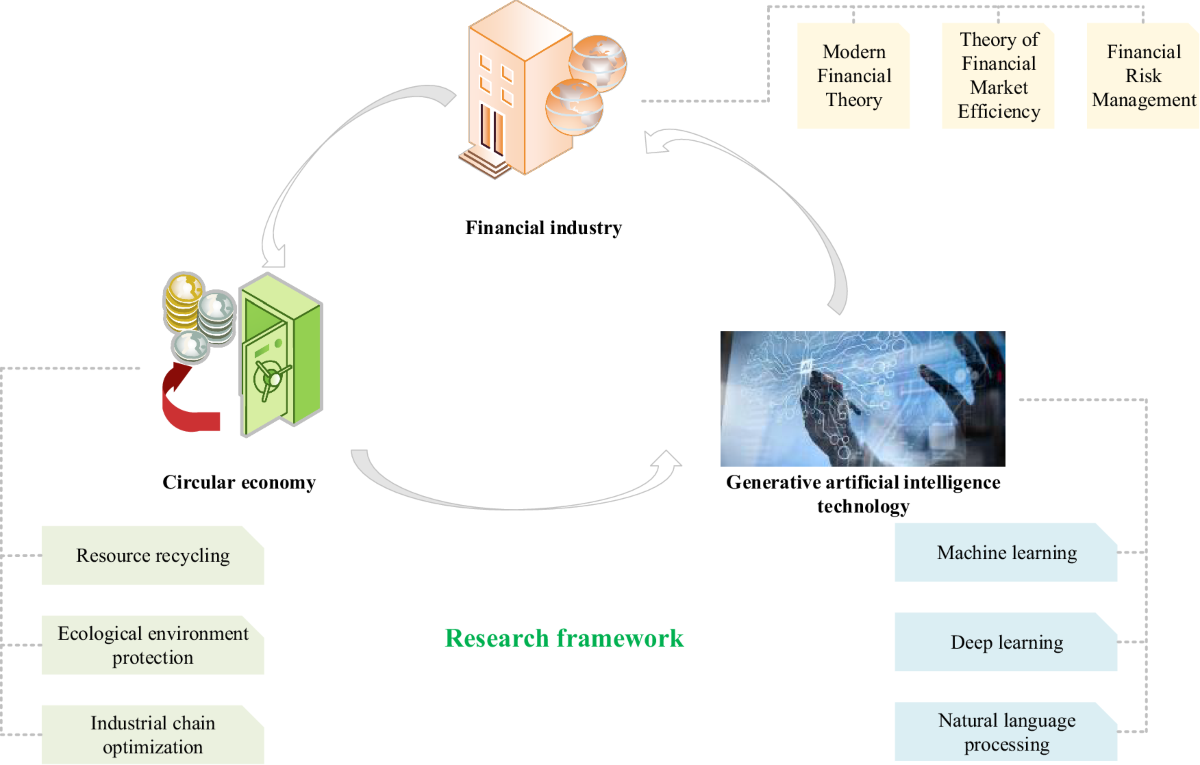

Technology and the Evolution of Financial Systems

Technological advancement has reconfigured the landscape of finance. Automation accelerates transactions. Algorithms optimize portfolios. Digital platforms democratize access to financial instruments once reserved for institutional elites.

Yet, technology introduces new complexities. Cyber risk, data integrity, and algorithmic opacity demand vigilance. Finance must evolve alongside technology, integrating innovation without surrendering control. The future belongs to systems that are efficient, transparent, and resilient.

Corporate Finance and Organizational Value

Within organizations, finance orchestrates value creation. It informs investment decisions, pricing strategies, and performance evaluation. Financial metrics translate operational activity into measurable outcomes, enabling accountability and strategic alignment.

Sound corporate finance aligns incentives with outcomes. It ensures that growth initiatives generate returns exceeding their cost of capital. When financial governance is disciplined, organizations allocate resources with clarity and purpose rather than intuition alone.

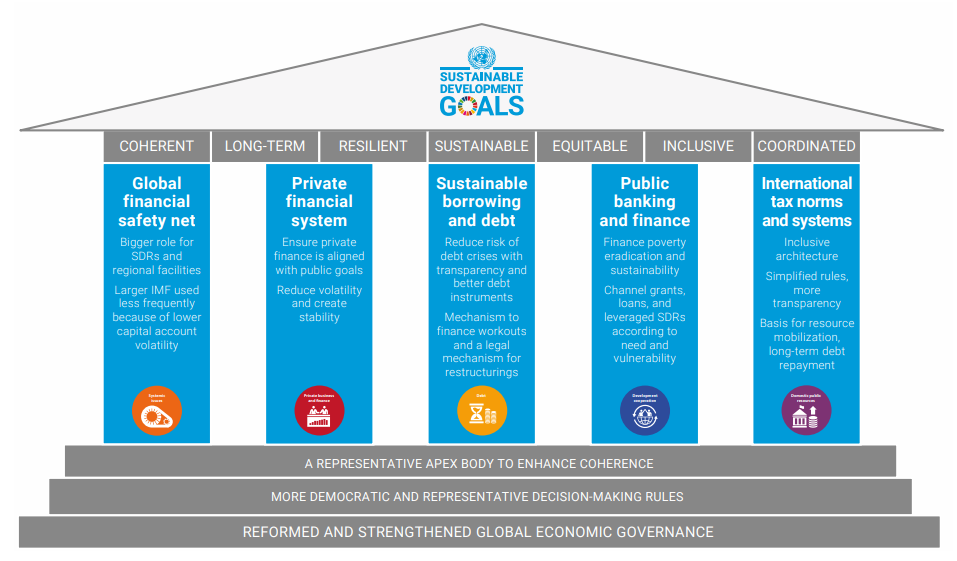

Public Finance and Economic Infrastructure

At the macro level, finance underpins public infrastructure and social systems. Government budgets, taxation policies, and debt management shape economic stability and social equity. Public finance balances fiscal responsibility with developmental priorities.

Mismanagement at this level carries systemic consequences. Inflation, debt crises, and capital flight often trace back to fiscal imprudence. Effective public finance sustains trust, enabling long-term investment in education, health, and infrastructure.

Ethics, Transparency, and Financial Integrity

Ethical considerations are integral to finance. Transparency, accountability, and regulatory compliance preserve confidence in financial systems. When integrity erodes, trust dissipates rapidly.

Ethical finance does not inhibit profitability. It reinforces it. Markets reward credibility. Institutions that embed ethical frameworks into financial practice mitigate reputational risk and foster durable relationships with stakeholders.

The Enduring Relevance of Finance

In its essence, finance is the discipline of stewardship. It governs how resources are acquired, deployed, and preserved across time and uncertainty. Whether managing personal wealth, corporate capital, or public funds, finance shapes outcomes that extend far beyond balance sheets.

As economies grow more interconnected and complex, the relevance of finance intensifies. Those who approach finance with discipline, insight, and ethical resolve do more than manage money. They construct stability, enable progress, and shape the contours of future opportunity.