The Conceptual Foundations of Finance

Finance is the discipline through which economic value is quantified, mobilized, and preserved over time. It governs how capital flows across markets, institutions, and individuals, shaping outcomes that extend far beyond monetary gain. At its most fundamental level, finance reconciles scarcity with ambition, translating limited resources into structured opportunity.

This field is neither static nor simplistic. Finance evolves alongside economic systems, absorbing influence from geopolitics, technology, and human behavior. Its relevance persists because every decision involving resources—whether personal, corporate, or governmental—ultimately converges within its framework.

Capital Formation and Allocation Dynamics

Capital formation is the genesis of productive activity. Savings become investment. Investment becomes growth. Finance orchestrates this transformation through mechanisms designed to channel funds toward ventures with the highest potential return adjusted for risk.

Allocation, however, is never neutral. Each deployment of capital implies strategic intent and opportunity cost. Finance evaluates these trade-offs with analytical rigor, ensuring that resources are not merely expended, but positioned. Precision in allocation distinguishes enduring institutions from transient ones.

Risk Architecture and Financial Prudence

Risk is the shadow companion of finance. Markets fluctuate, assumptions fracture, and forecasts expire. The objective is not to eliminate risk, but to architect it intelligently. Financial prudence lies in exposure calibration rather than avoidance.

Diversification, hedging, and scenario analysis form the structural defenses against uncertainty. Yet, models alone are insufficient. Judgment remains paramount. Finance demands the capacity to interpret incomplete information while maintaining strategic composure under volatility.

Liquidity, Leverage, and Structural Balance

Liquidity ensures operational continuity. Leverage amplifies capacity. Both are central to finance, and both carry inherent tension. Excessive leverage magnifies fragility. Insufficient liquidity constrains agility.

Sound finance balances these forces through disciplined cash flow management and capital structure optimization. Stability emerges not from abundance, but from equilibrium. Organizations and individuals alike falter when this balance is ignored.

Behavioral Forces in Finance

Rationality is often assumed in financial theory, yet reality is shaped by emotion and cognition. Behavioral finance examines the psychological currents that influence decision-making, revealing why markets deviate from equilibrium.

Fear accelerates sell-offs. Overconfidence inflates valuations. Herd behavior distorts fundamentals. Awareness of these tendencies refines financial judgment, introducing restraint where impulse might otherwise dominate. In this sense, finance becomes a study of human temperament as much as numerical analysis.

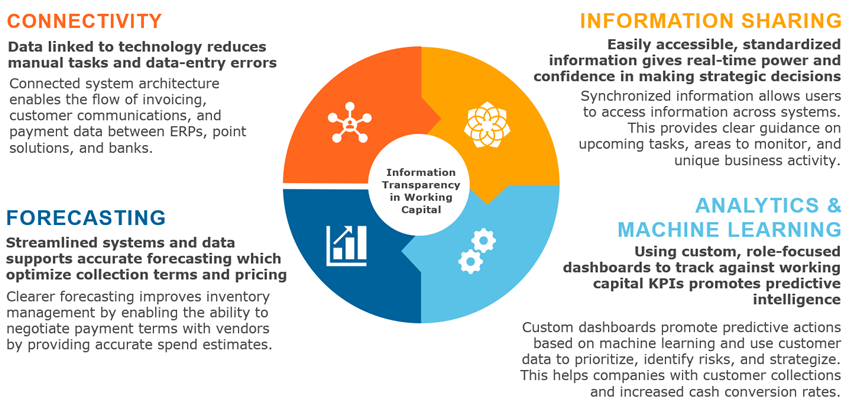

Technology and the Transformation of Financial Systems

Technological innovation has redefined the infrastructure of finance. Digital platforms accelerate transactions. Algorithms execute strategies at unprecedented speed. Data analytics uncover patterns once obscured by complexity.

However, progress introduces fragility. Cybersecurity risks, algorithmic opacity, and systemic interdependence demand vigilant oversight. Finance must integrate technology without surrendering transparency or accountability. The future belongs to systems that are efficient yet intelligible.

Corporate Finance and Strategic Coherence

Within organizations, finance functions as the integrative logic that aligns operations with strategy. Investment appraisal, capital budgeting, and performance measurement translate vision into executable plans.

Corporate finance ensures that growth initiatives generate returns exceeding their cost of capital. It disciplines ambition with evidence, converting aspiration into sustainable value creation. When financial governance is robust, organizations navigate complexity with clarity.

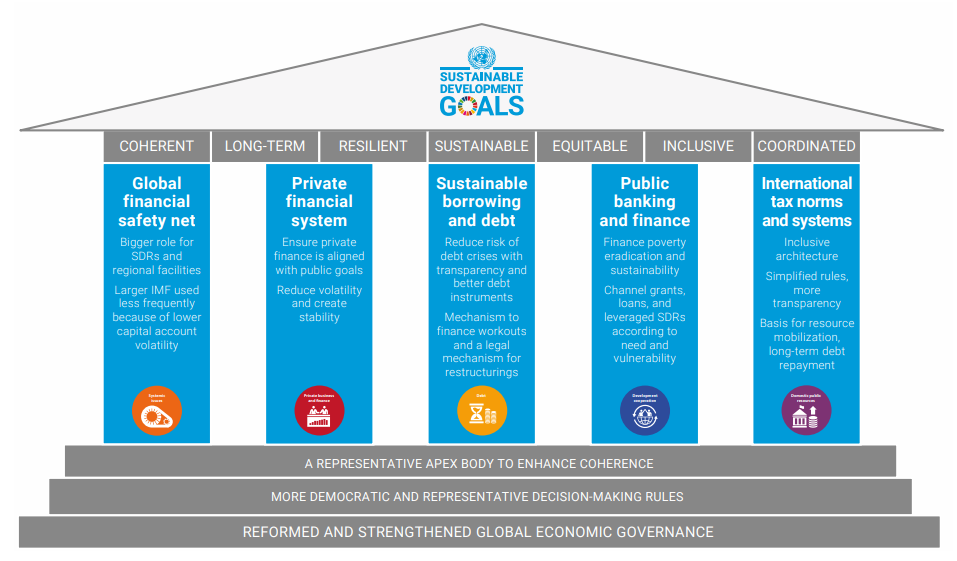

Public Finance and Societal Infrastructure

At the macroeconomic level, finance underpins public infrastructure and social cohesion. Fiscal policy, taxation, and sovereign debt management shape economic stability and developmental capacity.

Effective public finance balances immediate social needs with long-term sustainability. Misalignment invites inflationary pressure, fiscal imbalance, and diminished public trust. Prudence at this level preserves not only economic health, but institutional legitimacy.

Ethics, Transparency, and Financial Credibility

Ethics are inseparable from finance. Transparency sustains trust. Accountability reinforces credibility. When financial systems operate without integrity, confidence erodes rapidly.

Ethical finance is not antithetical to profitability. It enhances durability. Institutions that embed ethical standards into financial practice mitigate reputational risk and attract long-term capital. Trust, once established, becomes a strategic asset.

The Enduring Relevance of Finance

In its essence, finance is the architecture of stewardship. It governs how resources are acquired, deployed, and preserved across uncertainty and time. Its influence extends from individual livelihoods to global economies.

As complexity intensifies, the importance of disciplined finance grows. Those who engage with finance thoughtfully do more than manage capital. They shape resilience, enable progress, and construct the foundation upon which future prosperity is built.